Is Investing in Exotic Cars a Viable Financial Strategy or Just a Dream?

Have we ever thought about whether investing in exotic cars is a viable financial strategy or just a delightful daydream?

As we pace through life, it’s not uncommon to fantasize about that sleek, engine-purring machine that could make us feel like James Bond (minus the spy gadgets, unfortunately).

Still, before we get lost in the imagery of cruising down the coast in a Lamborghini, let’s hit the brakes and take a closer look at the realities of investing in these shiny beasts.

The Allure of Exotic Cars

Just picture it: the wind in our hair, the roar of the engine, and the admiring glances from passersby. Exotic cars are not just vehicles; they are status symbols, pieces of art, and, for some, a form of investment. But why do we feel the magnetic pull toward them?

Exotic cars leave us drooling for a few reasons. First off, they often represent luxury, power, and a lifestyle that most of us can only dream about while sipping on our well-earned, affordable coffee.

Also, the craftsmanship that goes into these machines makes our hearts race faster than a sports car on a racetrack. However, reality check: can they truly make our bank accounts look as good as they do?

The Financial Fantasies

When we think of investing, the usual suspects - stocks, real estate, bonds - come to mind.

But exotic cars?

That’s like bringing a roller chair to a Ferrari showcase. So, let’s break it down:

- Depreciation: Did we know that cars, unlike fine wine, tend to lose value as they age? In fact, most cars lose about 20% of their value the minute we drive them off the lot. This depressing phenomenon is not just limited to our run-of-the-mill sedans; exotic cars are not immune, either - and in some cases, they depreciate even faster.

- Market Demand: There are exceptions to every rule. Certain models can appreciate in value, depending on a multitude of factors. Limited editions, famous models, or once-loved vehicles that have been lovingly restored can sometimes fetch a price that would make even our mother’s prized porcelain collection seem common.

Understanding the Market

Let’s get something straight: the exotic car market is not our typical shopping spree at the mall. Navigating this labyrinth of luxury requires us to have more than just a sturdy wallet; we need knowledge, charisma, and possibly a crystal ball.

What Determines Value?

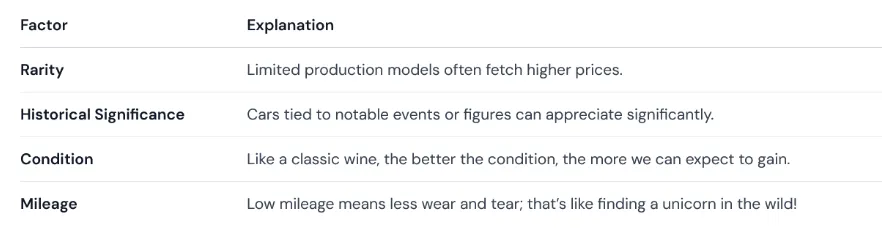

Exotic cars’ values oscillate based on their make, model, and condition. Here’s a quick rundown of factors to chew on:

The Trends We Should Follow

For us to hit the jackpot in the exotic car world, we need to be jazzed about trends. Some vehicles become cult classics, while others simply slip into obscurity like that pair of bell-bottoms we thought we’d re-wear. Research, follow auctions, and attend car shows!

The Costs of Ownership

We have to face the music: owning an exotic car isn’t just a glamorous ride down memory lane - it can drain our accounts faster than we can say "car insurance."

Insurance and Maintenance

Let’s chat about costs. Insurance for exotic cars can be, shall we say, extravagantly high. Depending on the model, we could be looking at premiums that make our life choices feel like a budget vacation.

Then there’s maintenance - these vehicles require precision and care. A lovely tune-up could quickly turn into an unscheduled financial rendezvous that could rival our college tuition fees.

Storage and Upkeep

Exotic cars need loving homes too, and not just any garage will do. Ideally, we should have a climate-controlled area that rivals a Four Seasons hotel room. Who knew our vehicles required more pampering than a cat at a pet spa?

Potential Financial Gain

All right, we’ve dished the dirt, but what about the positives? If we navigate this world wisely, can we make money? Spoiler alert: absolutely—if we play our cards right.

Long-Term Appreciation

While most cars depreciate, some gems appreciate in value over time. For instance, classic Ferraris or Lamborghinis have shown significant value increases. But here’s the catch: we need to get in while the getting is good. That means extensive research and a little bit of a gambler’s spirit.

The Joy Factor

Let’s not forget the joy of ownership! It might not fill our bank accounts, but the satisfaction of driving around town in a head-turning machine can feel like a million bucks, even if our actual budget is more along the lines of “dinner and a movie.”

The Risks Involved

Now, let’s sprinkle in some caution before we dash off to buy that Bugatti. We need to keep our eyes wide open.

Market Volatility

The exotic car market can be as fickle as our last Tinder date. Trends change, tastes evolve, and we might find ourselves holding an asset that’s gone out of style faster than that neon tracksuit from the ‘80s.

Lack of Liquidity

Exotic cars are not the most liquid of assets. If we need cash quickly, selling a car isn’t like cashing in stocks. It can take time, and in a down market, we’re likely faced with a hard reality - our prized possession might fetch less than we hoped.

The Exotic Car Investment Strategy

So where do we go from here?

If we’re serious about blending passion with potential profit, we need a game plan.

Research, Research, Research

Remember, forewarned is forearmed. We need to gather as much information as possible about specific models, market conditions, and upcoming trends. Knowledge is not just power; it's our best armor in this somewhat treacherous terrain.

Network with Enthusiasts

Join clubs, attend car shows, and connect with other enthusiasts. This is how we can gain insights into what’s trending and what’s not, all while feeling pretty slick ourselves. Nothing bonds people like a shiny hood ornament and an engine roar!

Consider the Long Haul

If we’re getting into exotic cars with an eye for investing, a long-term strategy will protect us against market fluctuations. While a classic may need patience like a slow-cooked meal, it can reap rewards in the end—and we’ll have the stories to tell.

Keep Emotions in Check

Nothing sends us down a financial rabbit hole like emotions. We need to remember that we’re investing and not just hugging our newfound shiny friends. That Ferrari might catch our eye, but keeping our rational side intact will save us from falling head over heels into a financial black hole.

Our Final Ride

As we slow down to a stop, the question remains: is investing in exotic cars a viable financial strategy or just a dream?

The answer, like the car itself, is multifaceted.

Investing in exotic cars can provide a unique mix of pleasure and potential profit, but it requires an understanding of the market and the potential risks involved.

For some of us, it might be an exciting ride filled with joy, while others could see it as just another way to burn through cash faster than us binge-watching a new series.

Ultimately, combining knowledge, passion, and a sense of humor can lead us down the winding roads of exotic car investing.

Who knows?

We might just find ourselves cruising both the highways of joy and the backroads of investment profits.

And remember, whether we wind up cruising down the highway in an exotic car or watching Netflix in our aging Toyota, it’s about the journey—and the laughter—along the way.